Gold Fields rides high gold prices but battles rising production costs

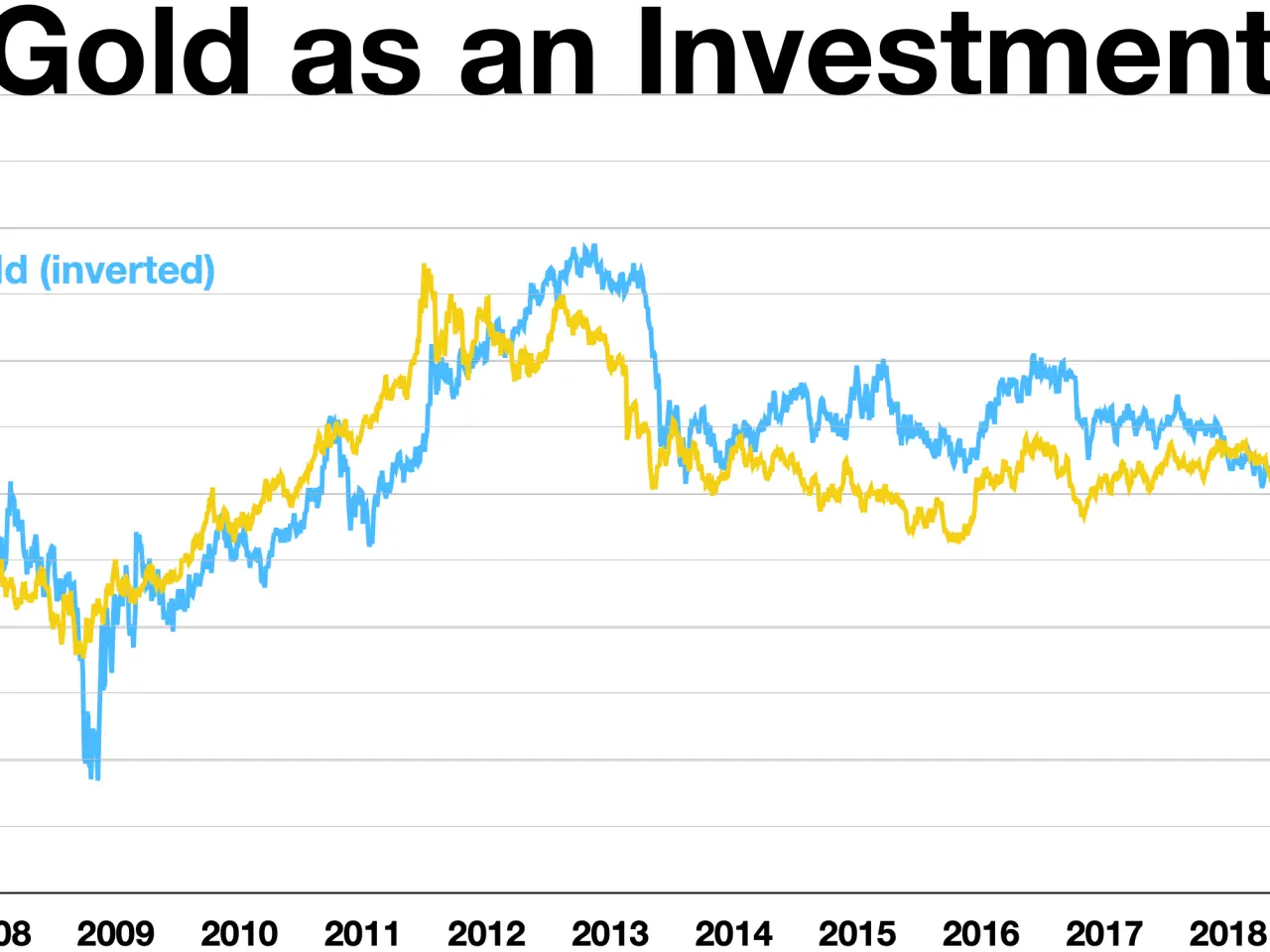

Gold Fields, a leading global gold producer, is navigating a mixed financial landscape. While soaring gold prices have boosted its stock performance, rising production costs and geopolitical tensions continue to test its resilience. Investors remain watchful as the company adjusts its forecasts amid ongoing challenges.

The South African-headquartered miner has benefited from strong gold prices over the past year. This surge, combined with productivity gains, has delivered substantial returns for long-term shareholders. Yet, the company now faces mounting operational expenses, including higher energy bills and wage increases.

In response, Gold Fields has revised its production and cost projections. Analysts maintain a broadly positive view of the firm but urge caution, noting that further upside may not come easily. Despite its solid market position, no major new projects have been announced that could significantly shift its future outlook.

The company's stock has shown volatility in recent months. While it remains resilient against inflation and geopolitical instability, investors are closely monitoring cost pressures and potential project risks.

Gold Fields continues to balance strong gold prices with escalating production challenges. The revised forecasts reflect ongoing cost pressures, though analysts still see value in the company's long-term prospects. For now, its performance will depend on managing expenses while capitalising on favourable market conditions.